4 Year End Tax Strategies for San Francisco Bay Area Businesses

Before I dive into some year end tax strategies San Francisco Bay Areabusiness owners can and should be making, I want to address some rumors and misinformation about the SALT workarounds that are available to some of our clients (though not all).

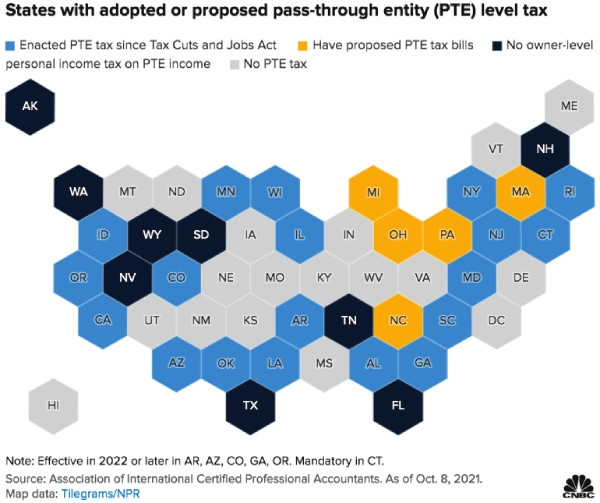

Essentially, 22 states (as of this writing) have enacted legislation that enables business owners operating in a partnership or S-corp to deduct their state and local taxes (SALT) beyond the 10K cap that exists on federal returns. These are the states that currently provide this workaround in some measure:

Contrary to what some tax practitioners have been saying, in most cases, you do NOT need to pay these taxes by 12/31/21 to elect for this workaround (if you are eligible). In almost every case, you make this election when you file your entity tax return (often on March 15th), and it will then enable you to claim that deduction on your personal return.

There are nuances state by state (for instance, the deadline to have made this election in New York has already passed). But do NOT fall prey to the rumors that you have to suddenly write a big check right now, this week, to have this help you.

If you need to talk this over, we’re right here:

(408) 241-4100

(And please be patient. I can't guarantee our availability, as we have a LOT of client work to handle these few days before year-end ... but we'll do our best!)

Now ... a few year end tax strategies you might should consider this last week of the year, in case you haven't already...

4 Year End Tax Strategies for San Francisco Bay Area Businesses

"We didn't lose the game; we just ran out of time." -Vince Lombardi

As I mentioned to my family clients, time is short, and some moves do require more than this week to pull off -- so I'm restricting myself to year end tax strategies which you can realistically do something with before the end of the year.

And, again--these are focused on what will apply to your San Francisco Bay Area business. If you didn't get that list for a personal/family return, let me know, and we'll shoot it over to you.

1) Buy Supplies in Advance (to increase expenses and offset income)

How much disposable equipment do you expect to use in 2022? Order it now so the cost is deductible in 2021 if you need to offset income. Buy what you think you'll need for the coming year, as long as you have the space to store it. This is especially easy to do with software, information courses, or other subscriptions that you know you want to keep.

A word of caution: Under a 12-month rule, you cannot deduct prepaid expenses that run more than the end of the year following the current year. For example, if you prepay a three-year subscription to a trade journal, the cost is deductible over three years (not just one).

2) Work Now, Bill Later

Instead of sending an invoice immediately so you'll receive payment this week, consider waiting until next week. This will ensure that payment is received in 2022, and taxes on the income are deferred for another year. However, it may make sense to adopt the opposite approach -- bill immediately to receive the income this year.

3) Get Ahead On Other Vendor Costs

You may have bills piled up that are not due until 2022. If you pay them now, you can deduct the expenses in 2021. Don't have the funds in your bank account at the moment? Consider putting the expenses on your business credit card if the vendor or other party allows it. Costs charged to credit cards before the end of the year are deductible this year even though the credit card bill isn't due until 2022.

4) Pay Out Some Year-End Bonuses

Many companies do NOT do this, but this is a quick way that you can reduce your taxable income for 2021 in your San Francisco Bay Area business. Obviously, you'll need to move rather fast on this and do it through your payroll system.

I know there aren’t many hours left to make these year end tax strategies, but if you can squeeze out just a little time for them, you’ll see the good they’ll bear on this year’s taxes. Let’s make the most of what’s left of 2021 and finish strong.

Happy New Year,

Patti ONeill and Gale Bergado

(408) 241-4100

ONeill & Bergado